Building credit is important for getting the best possible credit cards, loans, and mortgages. Even if these things seem far away, the sooner you start building your credit, the better. The soonest you will feel the effects is when opening a student account (the higher your credit, the more perks you will have). It’ll also affect whether you will be accepted for a mortgage, a loan, a credit card, a mobile phone contract, or some types of car/home insurance. Here’s a guide to start building a (good) credit rating, so you’ll be accepted for financial opportunities.

Age 11:

- Open a bank account. A history with banking institutions will be useful in some scenarios.

Age 16:

- Register to vote (puts you on the electoral roll) if you meet the following criteria:

- 16 years old or over (but you cannot vote until you are 18 years old)

- A British citizen (living in the UK, or abroad)

- An Irish, Commonwealth or European Union citizen living in the UK

- If you can’t register to vote because you’re not one of the citizens listed above, and you live in the UK, send your proof of residency (e.g. in the form of a utility bill, UK driving license, or bank statement) to the three credit agencies (see below). Ask them to add a note to your credit report to confirm your residency, and for them to verify that they have done this.

Ages 18 and over:

Employed (ideally with an income greater than £10,000):

Open a credit building card. You may also opt for a store card with a specific store if they offer one.

Students:

Before starting university or an apprenticeship, you may wish to convert your current bank account to (or open a new) student bank account (this is credit checked for the overdraft facilities). A bank account doesn’t build credit, so you will have to pair your student bank account with a student credit card (scroll down).

Tip: spend money on the credit card, then setup a direct debit to pay it off monthly with your bank account. (Find more tips below).

Not in education, employment, or training (or earning less than £10,000 per year):

If you’re not in education (university), employment, or training (apprenticeship), or you earn less than £10,000 a year, then it’s trickier to start a credit line, especially if you have no credit history. Getting a standard credit card is near impossible since that kind of credit line is unsecured. Instead, consider the follow options, in order of recommendation:

- Sign up as an additional cardholder (or authorised user) on somebody else’s credit card, like your parents’. You will build history this way, although less than if you were to have your own credit line. There is a financial risk to the account holder (e.g. your parent), since they are legally responsible for all debt on the card, and not you.

- You can purchase a prepaid (or secured) credit card which can help build credit. The card acts like debit cards, and you can only spend how much money you, yourself have put on the card (a deposit, if you will). However, there are usually fees to help the company cover the cost of reporting your data to the credit agencies.

- Joint credit cards are also an option, but there is a significant risk that one person’s debts can adversely affect the other joint card holder. I would not recommend this, because mismanagement of the account affects both users negatively — and a bad credit score hurts your financial status. Furthermore, your financial history may become linked, which isn’t great if one of your credit ratings worsens over time.

Always use an eligibility calculator before making a formal application for credit.

Once you apply for a credit card, the company will conduct what is called a hard search with one of the credit agencies to check for your identity and/or financial reliability. This leaves a mark on your credit report which lasts 12 months, and a lot of applications in that period can make you look desperate for credit, making you unattractive to lenders, and lowering your credit rating.

However, you can use a free eligibility calculator (check comparison sites, or use one of the three credit report sources below), to see if you qualify for any credit, loans, insurance etc. without it impacting your credit rating. This is because they perform a soft search for your credit rating, and it will not affect your credit rating. This means you can shop around for the best insurance, loans, cards, etc.

Other ways to improve (or maintain) your credit rating:

- Mortgages

- Loans

Some consumer loans (mobile contracts, car insurance, payday loans) will not build credit, but missed payments may end up on your credit file. - Utility bills (gas, electricity, water, broadband, landline)

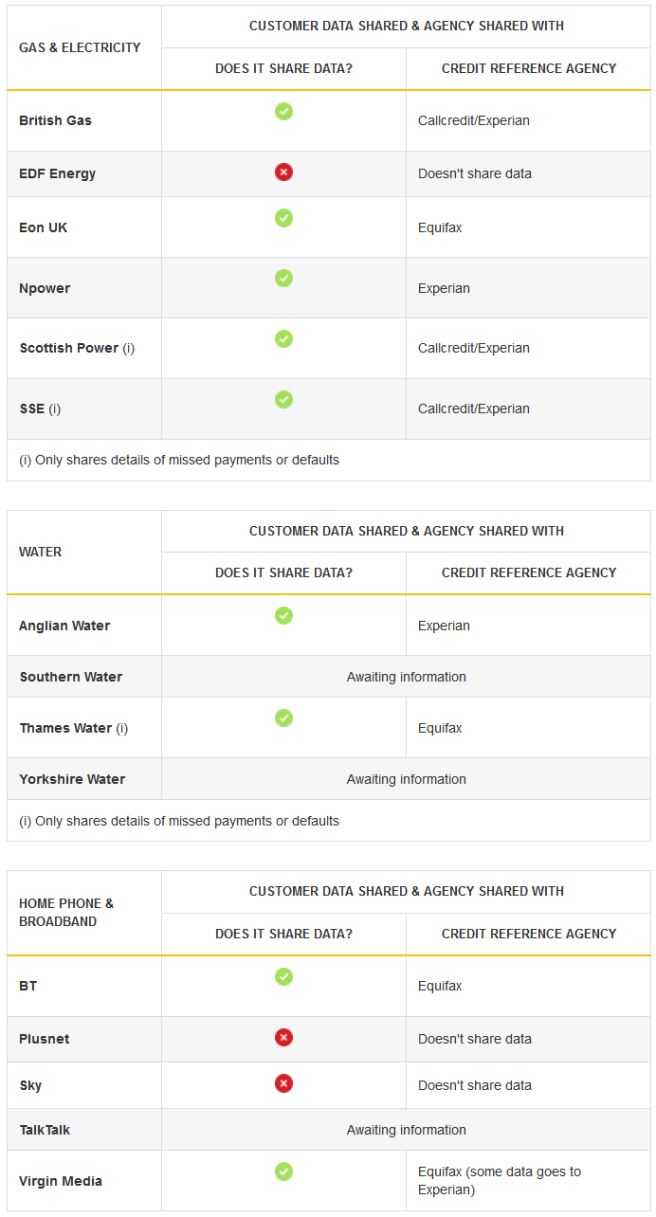

Not all utility companies will report to credit agencies. Furthermore, of those that do, they may only share limited data, which will not affect your score positively, but may affect it negatively if you miss a payment. However, some exchange full repayment data, and this could have a positive effect on your credit rating!

- Rent: if you pay private rent (not council rent), sign up for the Rental Exchange Scheme. NOTE: even if you don’t sign up for the scheme, your letting agent or landlord/lady could report missed payments to credit agencies.

Any of the above in your name may help build credit. Ask your parents to put your name on one or two bills. They can setup a direct debit into your bank account to cover the cost, or authorise agencies to take the payments from their bank. Remember to pay bills in full each time.

Flat/house sharing?

If you live with other people, as you did with your parents, opportunities exist to build credit when paying utility bills or rent. Put your name on at least one bill, otherwise someone else will claim the credit for themselves. There is always a risk when sharing a living place if people don’t pay their share of the bill on time. Let’s observe our options for splitting the bills:

- Joint account for rent and utilities

This builds credit for everyone listed on the contract if bills are paid on time, but also holds everyone accountable if a payment is missed/late, negatively affecting the credit rating of all. Furthermore, you create a financial link to participant’s financial history, which may mean their previous (or future) problems could adversely affect you. This is very serious, and rather unfair in my view, so I would only recommend a joint account with a trustworthy partner (i.e. spouse, parent). - Individual accounts

This is a safer option as you can assign separate individuals to different bills, but still chip in for the bills by paying into each other’s bank account. For example:-

Josh pays the rent (use the Rental Exchange Scheme)

Alex pays for gas and electricity

Tom pays for broadband and landline - However, you will become solely responsible for all payments, so this is still risky (e.g. if a flatmate doesn’t cough up their share of the bill), but less risky than a joint account would be, since your financial history won’t become tied with theirs for a number of years.

-

Credit Card/Rating Tips

- Keep your overall AND individual credit utilisation low (below 30% is good, below 10% is even better) e.g. if your credit limit is £1000, keep a balance below £300. If you have multiple credit cards, spread the cost over all of them, rather than maxing one out, and spending close to nothing on the other(s).

Try not to have 0% credit utlisation, as for some lenders, this is a bad sign (as zero spending shows no history for that time period). - Use your credit card every month (to build a credit history). Spend money on the credit card, then setup a direct debit to pay it off monthly with your bank account.

- Pay back in FULL every month (setup a direct debit linked to your bank account). This avoids paying for interest if you pay the invoice in full before the next statement date.

- If you can’t pay back in full, pay above the minimum amount that is due for that month to reduce the interest charged on your remaining balance.

- Avoid withdrawing cash on your credit card, missing payments (at the very least, pay the minimum), or maxing out your card. These are signs of being financially irresponsible.

- Don’t close your credit (or bank) account, as a history of 6+ years is great. If you must close some accounts, close the newer accounts.

- Don’t move houses too often. Living for many years at your current address shows stability. If you are a student, use your parents’ address for financial application (because you are likely to move accommodation a number of times throughout your course).

- Being a homeowner is also better than renting, or living with parents as it shows stability (your condition is unlikely to change because you don’t have to keep up with rent or risk being kicked out of the house by your parents).

- Space out your credit applications! Applying for too much credit at once, whether you are rejected or accepted, will make you seem desperate for credit, and will tank your credit as those ‘hard searches’ will stay on your file for 12 months.

- Use a free credit eligibility calculator.

- Be consistent and truthful in your applications. There are separate anti-fraud agencies that is employed. One verifies your information is consistent with previous credit applications, and the other is a database of known fraud.

- National Hunter checks of inconsistencies

- CIFAS is a database of known fraud

Monitor your finances. In the UK there are 3 credit agencies. Here’s a free way to check your (monthly) credit report with each of them:

- MSE Credit Club for Experian

- ClearScore for Equifax

- Noddle for Call Credit

Now that you have access to your report, fix any errors:

- Correct mistakes on your credit file

- Look out for fraud (e.g. any credit applications you don’t recognise)

That brings you to the end of what to do to build and improve your credit rating. Of course, there are many things you shouldn’t do, but you can easily search for those, or go against the advice given above.

“For over a year, we’ve given you a Free Credit Score and Report from Experian via the MSE Credit Club – which also includes your Affordability Score, Credit Hit Rate (your overall chances of getting top products), plus help on boosting them. Now we’ve dived into the data, in a secure and anonymous way, to uncover the credit score killers and helpers (all score changes are the average across Credit Club members, from a max 999)…

- Filing for bankruptcy or getting a county court judgment on your credit file – 190 pt DROP. It’s a key killer and will stay on your file for six years. There’s help in our Credit Club if you’re deep in the financial mire.

- Missing card, loan, mortgage etc payments – 125 pt DROP (if you miss 1-3 in a month). This is a biggie most can avoid. ALWAYS set up direct debits to make at least the minimum payments (or pay IN FULL if you can). If you’re set up for the min but want to overpay, you can do this manually.

- Making 4+ applications in one month – 105 pt DROP. This can make you look desperate for credit. Making one application has little impact but if you suddenly add 1-3 more in just a month it can mean an average 15-point drop. Make 4+ more and it’s a hefty 105 point hit. Beat this by using Credit Club’s eligibility calcs which show the products you’re most likely to get, BEFORE you apply.

- Getting on the electoral roll – 25 pt BOOST. Not being on it can make it difficult for lenders to ID you when you apply for credit. Yet registering to vote boosts it by an average 25 points – or 55 points if you’ve a poorer score. If you want to keep your details hidden, you can opt out of the public register. Full help, incl if you’re not allowed on it, in registering to vote.

- Steer clear of credit limits – 30 pt BOOST. If you borrow too close to your combined limits, lenders may deem you over-reliant on credit. Drop from over 60% ‘credit utilisation’ to under it (excl mortgages) and you’d see a boost. So pay down debt (a good thing anyway) if you can, but beware automatically closing down old accounts.”